Negli ultimi anni, il panorama delle piattaforme di casinò online senza registrazione è cresciuto in modo esponenziale, offrendo agli utenti accesso rapido e senza complicazioni a giochi d’azzardo di alta qualità. Tuttavia, con questa crescita enorme, è diventato fondamentale comprendere i criteri di valutazione che determinano quali piattaforme sono affidabili, sicure e piacevoli da usare. In questo articolo analizzeremo i principali principi che guidano la scelta di queste piattaforme, aiutando i giocatori a fare decisioni consapevoli e informate.

Principi fondamentali per la selezione di piattaforme di casinò senza registrazione

Qualità dell’interfaccia utente e facilità di navigazione

La prima impressione di una piattaforma di casinò senza registrazione è determinata dalla qualità della sua interfaccia utente (UI) e dalla facilità di navigazione. Un design intuitivo permette ai giocatori di trovare facilmente i giochi desiderati, accedere alle promozioni e comprendere le varie sezioni del sito senza confusione. Ad esempio, piattaforme come “PlayAmo” e “Vavada” si distinguono per layout chiari e menu intuitivi che riducono il tempo di apprendimento e aumentano la soddisfazione del giocatore.

Sicurezza e protezione dei dati personali

La tutela dei dati personali e delle transazioni è critica quando si sceglie un casinò online. Le piattaforme più affidabili adottano tecnologie di crittografia SSL (Secure Sockets Layer) per garantire che tutte le comunicazioni siano protette. Inoltre, verificano le licenze rilasciate da autorità europee come Malta Gaming Authority o Curacao e rispettano le normative sulla privacy (GDPR). Un esempio emblematico è Betominio, che ottempera rigorosamente alle normative di sicurezza e privacy, offrendo un ambiente di gioco sicuro.

Varietà di giochi e aggiornamenti disponibili

Un criterio importante è la gamma di giochi offerti, che dovrebbe includere slot, giochi da tavolo, roulette, blackjack, baccarat, e giochi dal vivo. La disponibilità di aggiornamenti frequenti e l’introduzione di nuovi giochi è indice di piattaforma dinamica e rispettosa delle preferenze dei consumatori. Ad esempio, piattaforme come “StarCasino” si aggiornano regolarmente, garantendo contenuti freschi e coinvolgenti.

Metodo di pagamento e velocità di transazione nelle piattaforme senza registrazione

Opzioni di deposito e prelievo senza verifica approfondita

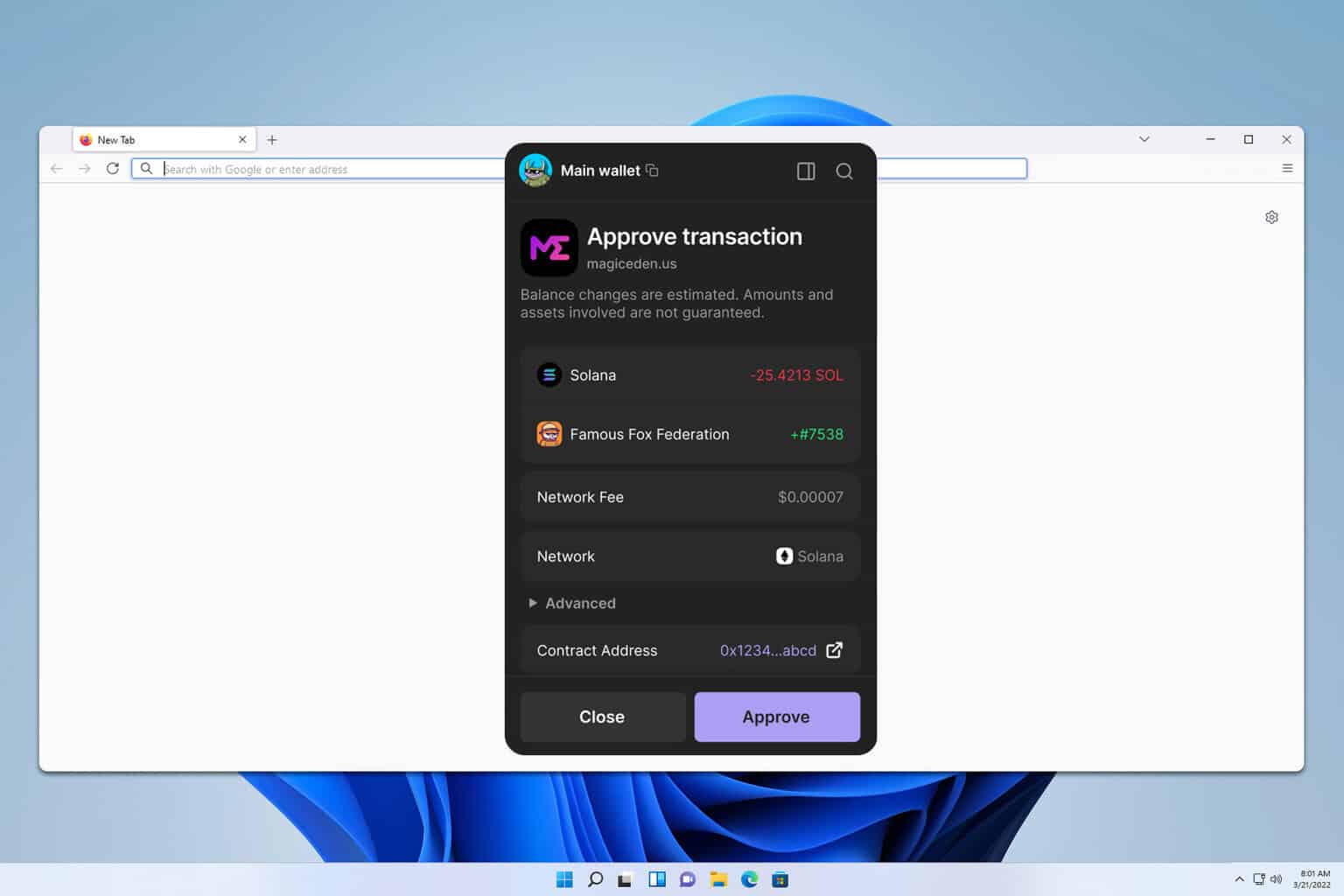

La praticità nei metodi di pagamento è essenziale per l’esperienza utente. Le piattaforme più popolari consentono depositi e prelievi tramite metodi come carte di credito/debito, portafogli elettronici (Skrill, Neteller), e cryptocurrency, spesso senza richiedere verifiche approfondite. Questa facilitazione è fondamentale per chi desidera un accesso rapido e senza ostacoli, come si vede su piattaforme come “JoyCasino”.

Tempi di elaborazione delle transazioni

Le transazioni rapide sono un elemento distintivo di piattaforme di successo. In media, i depositi vengono accreditati istantaneamente, mentre i prelievi variano da pochi minuti a 24 ore, in base al metodo scelto. La trasparenza dei tempi di elaborazione aiuta i giocatori a programmare le proprie attività senza sorprese.

Costi e commissioni associate alle operazioni

Le migliori piattaforme minimizzano o eliminano le commissioni sulle transazioni, offrendo un’esperienza più soddisfacente. Ad esempio, alcuni servizi di portafoglio elettronico applicano commissioni molto basse o nulle, contribuendo ad aumentare la percezione di affidabilità e trasparenza. Se desideri scoprire quali sono le piattaforme più affidabili, puoi consultare i dettagli su Casinobossy.

Valutazione dell’affidabilità e reputazione delle piattaforme di casinò online

Recensioni degli utenti e feedback verificati

Le opinioni degli utenti sono un indicatore forte dell’affidabilità di una piattaforma. Siti come Trustpilot offrono recensioni verificate, spesso evidenziando aspetti come rapidità dei pagamenti, assistenza clienti e qualità dei giochi. Un esempio positivo è CasinoMet, che riceve feedback costantemente positivi per il servizio clienti e la trasparenza.

Certificazioni e licenze ufficiali

Le piattaforme più affidabili possiedono licenze rilasciate da autorità riconosciute, come Malta, Gibilterra o Curacao. Questi documenti certificano il rispetto di elevati standard di sicurezza e correttezza, tutelando i giocatori da pratiche fraudolente.

Storia di eventuali controversie e risoluzioni

Valutare la storia di controversie passate e come sono state risolte è importante. Piattaforme che hanno gestito efficacemente problemi o che mostrano trasparenza nelle risoluzioni tendono ad essere più affidabili. La trasparenza nelle controversie evidenzia un impegno serio verso la tutela del cliente.

Impatto delle promozioni e bonus sui criteri di scelta

Tipologie di bonus offerti senza registrazione

Le piattaforme senza registrazione spesso offrono bonus di benvenuto, come giri gratuiti o cashback, subito accessibili senza processo di verifica. Questo incentivo favorisce la prova immediata delle piattaforme, stimolando la fiducia e l’interesse dei giocatori.

Condizioni di utilizzo e trasparenza delle offerte

La chiarezza nelle condizioni di bonus è essenziale per evitare fraintendimenti. Piattaforme di qualità forniscono dettagli trasparenti su requisiti di scommessa, limiti di vincita e scadenze, riducendo il rischio di delusione o pratiche ingannevoli.

Effetti sulla soddisfazione e fedeltà dei giocatori

Offerte ben strutturate aumentano la soddisfazione del cliente e promuovono la fedeltà. I giocatori tendono a preferire piattaforme che offrono bonus equi e trasparenti, creando un rapporto di fiducia duraturo.

Innovazioni tecnologiche e funzionalità avanzate nelle piattaforme senza registrazione

Utilizzo di intelligenza artificiale e machine learning

Le tecnologie di intelligenza artificiale vengono impiegate per offrire un’esperienza di gioco personalizzata, raccomandando giochi in base ai comportamenti del giocatore e migliorando la capacità di identificare pratiche di gioco problematico. Ad esempio, alcune piattaforme integrano sistemi di supporto automatico e analisi predittive per ottimizzare l’offerta di contenuti.

Supporto a dispositivi mobili e compatibilità cross-platform

La crescente domanda di gioco da smartphone e tablet ha portato le piattaforme a sviluppare interfacce responsive o app dedicate. Piattaforme come “888casino” garantiscono compatibilità su vari dispositivi, assicurando un’esperienza fluida e coinvolgente indipendentemente dal device utilizzato.

Integrazione di giochi dal vivo e realtà virtuale

Le innovazioni più recenti includono i giochi dal vivo con dealer reali e le esperienze di realtà virtuale (VR). Queste tecnologie permettono ai giocatori di vivere un’esperienza immersiva e realistica, come se fossero in un vero casinò, rendendo l’intrattenimento più coinvolgente e innovativo.

In conclusione, la scelta delle migliori piattaforme di casinò online senza registrazione si basa su un insieme di criteri fondamentali: affidabilità, sicurezza, varietà di giochi, velocità e qualità delle transazioni, trasparenza delle offerte e innovazione tecnologica. Considerando questi aspetti, i giocatori possono godere di un’esperienza di gioco sicura, soddisfacente e moderna, in linea con le loro aspettative e necessità.